Online Estate Agent Statistics & Market Share

Average Prices & Fees

Average Asking Price in the UK

The average asking price for a property listed with an online agent is £281,949. This matches closely to the UK average price paid of £278,787.[1]

Bear in mind that the 'mean average' will be skewed upward by very expensive properties. The median price paid, i.e. the 50th percentile, is lower. In England and Wales, it is £235,000, according to the Office for National Statistics.[2]

Average Online Agent Fee

The average fee you can expect to pay depends heavily what package and services you're looking for. We've collated similar types of packages offered by agents to help you see what you can expect:

| Package Type | Average Price |

|---|---|

| Basic (Listing Only, No Photos) | £229 |

| Standard (Includes Listing, Photography) | £557 |

| Hybrid (Self-Hosted Viewings) | £803 |

| Hybrid (Accompanied Viewings) | £1,168 |

Average Savings Vs High Street

Using the lower, median average selling price of £235,000, it's possible to estimate how much you stand to save using an online estate agent.

Traditional high street estate agents usually operate on a commission basis. There is a considerable range of commissions, ranging from about 0.75% to 3%. An independent body's research came across multiple suggested commission averages: 1.3%, 1.5% and 1.8%. All of these exclude VAT of 20%, so the true amount a seller pays is higher than the listed figure. We will use this range of figures, but including VAT, to calculate the savings.

| Online Agent Package Type | 0.75% + VAT | 1% + VAT | 1.25% + VAT | 1.5% + VAT | 1.75% + VAT | 2% + VAT |

|---|---|---|---|---|---|---|

| Basic (Listing Only, No Photos) (£229) | £1,886 | £2,591 | £3,296 | £3,991 | £4,706 | £5,411 |

| Standard (Listing, Photography) (£557) | £1,558 | £2,263 | £2,968 | £3,663 | £4,378 | £5,083 |

| Hybrid (Self-Hosted Viewings) (£803) | £1,312 | £2,017 | £2,722 | £3,417 | £4,132 | £4,837 |

| Hybrid (Accompanied Viewings) (£1,168) | £947 | £1,652 | £2,357 | £3,052 | £3,767 | £4,472 |

It is worth bearing in mind that the higher the listing price of the property, the more you stand to save. This means an online agent might save you £15,000 on a million pound property, but conversely, if you are selling a lower-priced property, the savings made from an online estate agent can narrow, and in some rare situations, become negative. For example, 1.25% + VAT commission on an £75,000 property is £1,125, which is not a considerably higher fee than some hybrid estate agents.

Data Accuracy

We do our utmost to ensure these statistics are correct using a variety of means, including manually checking the number of properties listed live on property portals and on agents' websites. We also keep these numbers up to date and the tables and graphs should not be out of date any more than a week.

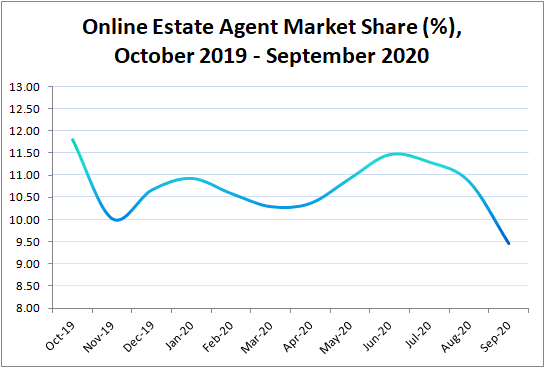

There is however scope for for discrepancies between our data and other sources (e.g. TwentyCI) due to methodology differences. Potential differences in methodology with other sources are:

- Determination of market share — we use the proportion of live listings at any moment in time, while other sources have been known to use records of property exchanges, which gives a more historical snapshot and also usually covers only England and Wales

- Listing Status — For sources which also use listing, it's possible there are exclusions based on listing status. OnlineAgentPicker attempts to exclude listings that are sold Subject to Contract (STC).

- Determination of what constitutes an online estate agent — The line between online estate agents and traditional estate agents is becoming blurrier all the time, especially with the arrival of hybrid estate agents. OnlineAgentPicker tries to take a 'common sense' approach: if we don't think a customer would consider the agent an online estate agent, we won't either. Usually this boils down whether a customer is able to physically visit the agent 'on the high-street', and if they can, we usually do not consider the agent as 'online', as much as they may make extensive use of online marketing and adopt similar fee strategies. Other sources' definitions may be more inclusive in this respect. It is also the case that other sources can exclude certain types of online estate agents, such as fast sale specialists, or hybrids.

- It is possible that new online estate agents can go unaccounted for by us, although we do think this is rare. These agents automatically contribute as "high street" agents in the relevant sections, and are excluded from internal online estate agent comparisons. In contrast, it is not possible for us to "over count" listings by online agents for any significant time. As such, the data we produce is more likely to suffer from a sampling bias in favour of underestimation of online agents' market presence.

- Dataset in use — we are only looking at online estate agents in respect to sales and selling, and are excluding online letting agents and letting activities at this time. Many other sources blend both sales and letting data together.